The model is NOT an introduction to Pro/3 knowledge modeling, but rather a reference for this introduction (Introduction to knowledge modeling with Pro/3).

Factual Knowledge

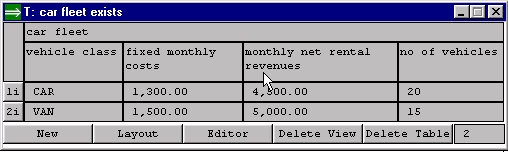

The Rent-a-Car business derives its income from renting out (on a monthly basis) two fleets of cars (cars and vans). There are some fixed and variable expenditures besides the servicing of a loan. The car fleet exists sentences define data of the two vehicle fleets (cars and vans). Fixed monthly costs and monthly net rental revenues are specified per vehicle. The fixed costs occur whether or not the vehicle is rented out. Note that "car" sometimes is used generically to mean both cars and vans.

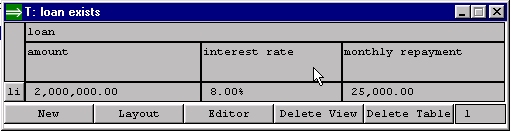

The loan exists sentence defines the loan liability:

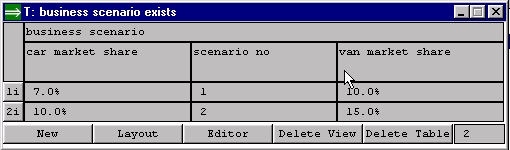

The business scenario exists sentences define the two business scenarios, that is, Rent-a-car's assumed market share for cars and vans.

The projection period is assumed sentence defines the length of the analysis period.

The market size is known sentences define the known market sizes for the two vehicle classes during the calendar year: (in NL format):

market data with no of rentals 140, vehicle class CAR and period 1 is known!

market data with no of rentals 170, vehicle class CAR and period 2 is known!

market data with no of rentals 190, vehicle class CAR and period 3 is known!

market data with no of rentals 210, vehicle class CAR and period 4 is known!

market data with no of rentals 220, vehicle class CAR and period 5 is known!

market data with no of rentals 250, vehicle class CAR and period 6 is known!

market data with no of rentals 350, vehicle class CAR and period 7 is known!

market data with no of rentals 300, vehicle class CAR and period 8 is known!

market data with no of rentals 180, vehicle class CAR and period 10 is known!

market data with no of rentals 140, vehicle class CAR and period 11 is known!

market data with no of rentals 180, vehicle class CAR and period 12 is known!

market data with no of rentals 60, vehicle class VAN and period 1 is known!

market data with no of rentals 100, vehicle class VAN and period 3 is known!

market data with no of rentals 250, vehicle class VAN and period 6 is known!

market data with no of rentals 350, vehicle class VAN and period 7 is known!

market data with no of rentals 300, vehicle class VAN and period 8 is known!

market data with no of rentals 130, vehicle class VAN and period 9 is known!

market data with no of rentals 100, vehicle class VAN and period 10 is known!

Rules

The rules in the Rent-a-car model are stored in nine realms: MARKET, CASHFLOW, CHARGES, CONCLUD, CONDPRO, ENERAL, INC-EXP, LOAN, RENTAL and SUMMARY. A few notes:

- the predicate is projected is used for various projections made without reference to one of the two business scenarios, i.e. projections which apply to both scenarios

- the predicate is conditionally projected is used for projections which are particular to a given business scenario

The CONDPRO rule states that anything that is projected also can be regarded as conditionally projected for either of the scenarios.

Assumed market size

The known market data are somewhat incomplete i.e. assumptions for some periods are missing. The MARKET rule defines how the incomplete data are made complete (with respect to assumptions for each period), through interpolation.

Operations revenue and expense rules

The operations revenue and expense rules are stored in RENTAL- and INC-EXP realms. The first

INC-EXP-rule (simple implication rule)

defines how projected expense cash flows are derived from the

fixed monthly costs of the existing car fleets. The second

INC-EXP-rule (simple implication rule) defines how conditionally

projected revenue cash flows (i.e. care rental revenues), are

derived from conditionally projected car rentals and the monthly

net rental revenues of the existing car fleets. The third

INC-EXP-rule (simple implication rule) defines Rent-a-car's fixed

monthly costs (salaries and rent).

The RENTAL-rule (simple implication rule) defines how

conditionally projected car rentals are derived from the existing

car fleets, the market share and market size assumptions. The

function market slice computes Rent-a-car's potential slice (in

terms of no of rentals) of the car/van markets (given vehicle

class, period and scenario no). The actual slice is the lesser of

the potential market slice and the number of vehicles in the

fleet.

Loan repayment and interest

The first LOAN-rule (simple implication rule) derives projected

(loan-)repayments from the existing loan. The second LOAN-rule (accumulation rule) derives

projected accumulated repayments from projected repayments. The

third LOAN-rule (simple implication rule) derives the projected

interest payments from the existing loan (which states the

starting balance and the interest rate) and the accumulated

repayments (which defines the total amount repaid at the end of

each month). Interest is based on the starting balance of each

month.

Bank charges

The CHARGES-rule (simple implication rule) defines how

conditionally projected bank charges are derived from

conditionally projected expense cash flows, interest payments and

repayments. The rule simply defines the bank charges as 10 per

such cash flow.

Cash flows

The GENERAL-rule (generalization rule)

defines that conditionally projected cash flows are

generalizations of conditionally projected expense cash flows,

revenue cash flows, (loan-)repayments, interest payments and bank

charges. The four CASHFLOW rules subsequently derive from the cash flow is conditionally projected

sentences: conditionally projected net cash flows, net discounted

cash flows, net present value and cash balances.

Conclusions and summaries

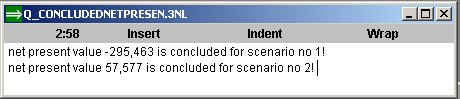

The four CONCLUD-rules derive different conclusions regarding the projected utilization of the car fleets. The SUMMARY-rule derives the ultimate conclusion of the projections, namely the net present value of the two business scenarios. The following two sentences represent the "final" derivation of the model:

The NPV figures used be different in older version of the RAC-model.